Risk & Portfolio Management

Products

Scroll

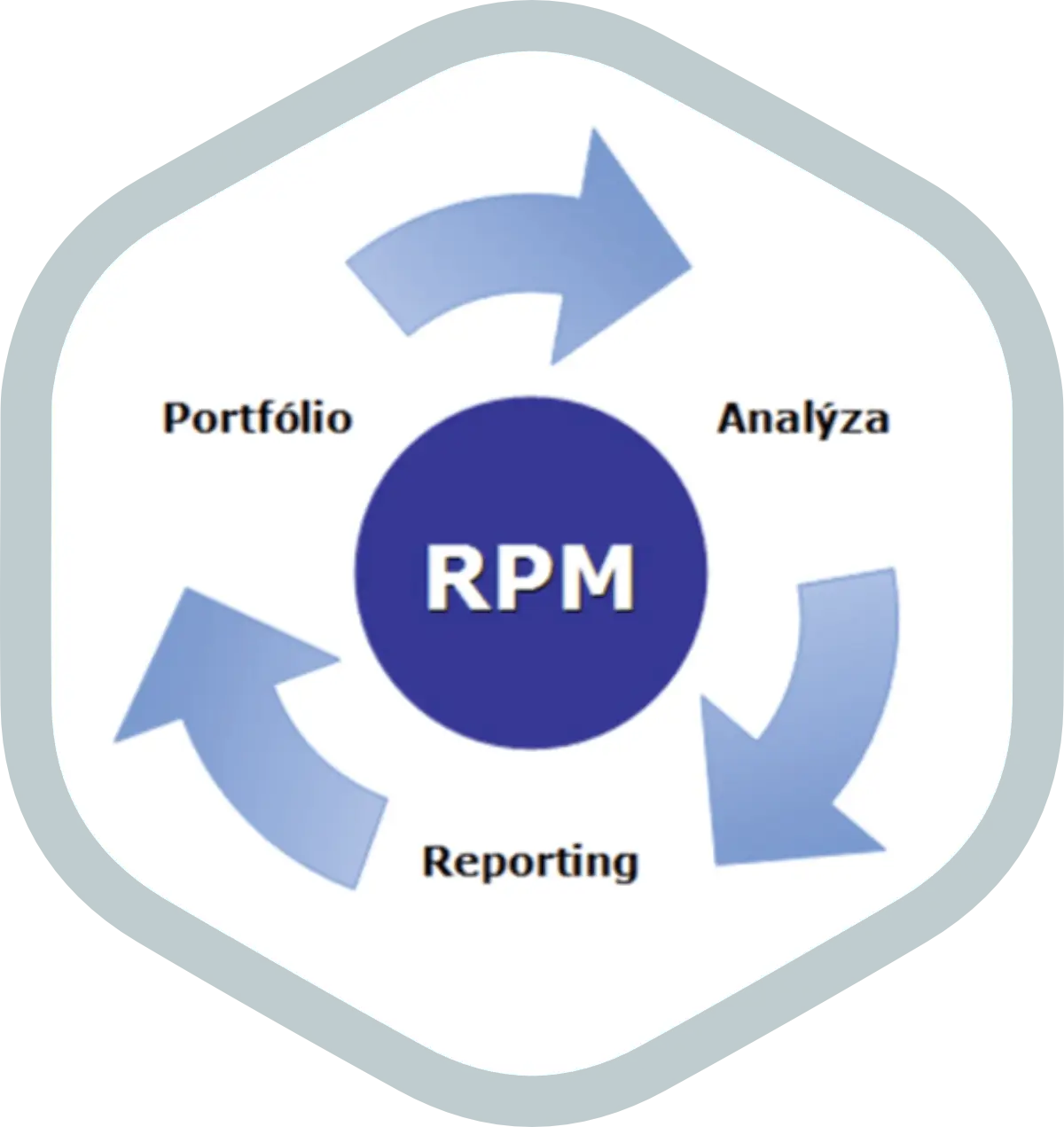

The Risk & Portfolio Management (RPM) application is a breakthrough in forward-thinking technology, designed for those seeking precise and comprehensive control over the risks of their investment portfolios.

With the powerful analytics backing that RPM provides, finance professionals can rely on sophisticated portfolio assessment and management, while having a wide range of tools at their disposal to predict and adapt to market fluctuations. The application is synonymous with innovation and detailed accuracy in risk analysis, enabling users to run thorough risk parameter assessments to ensure continuous improvement of investment strategies.

General product information:

The Risk & Portfolio Management (RPM) application is a cutting-edge analytical tool designed for comprehensive analysis and risk assessment of investment portfolios. RPM has become an integral part of portfolio management in many areas of the financial sector, including the management of collective investment funds, private portfolios, pension and insurance funds, and has also found its way into banking. Thanks to its modularity and scalability, it is able to adapt to different sizes and types of portfolios, making it a flexible solution able to meet the specific needs of each user.

Key features of the RPM application:

- Intuitive User Interface: Delivers fast and efficient access to analytical tools and reports without the need for extensive training.

- Modularity and scalability of the system: It allows the application to adapt to different sizes and types of portfolios and respond effectively to the growing needs of clients.

- Configurable outputs and integration with external systems: Allows users to customize reports to their specific needs and easily integrate the application with existing databases and systems.

- High security: Ensures that sensitive information is protected and accessible only to authorized users according to their role.

The main features of the RPM application include:

Calculating Value-at-Risk (VaR)

Provides an estimate of the maximum expected loss of a portfolio over a given time horizon and a given level of confidence.

Stress Testing

Simulates the potential impact of extreme market conditions on the value of a portfolio, helping to identify and manage risks.

What-if analysis and portfolio modelling

Allows users to anticipate and assess the impact of hypothetical changes in the market environment on the portfolio.

Conduct historical VaR analyses

Allows you to analyze past portfolio performance to better understand and anticipate future risks.

Are you interested in our services?

Mohlo by vás

zaujímať

Sme hrdí na úspešné projekty pre finančné inštitúcie a verejný sektor